Top 5 Features

The five features that our customers use the most - all for free!

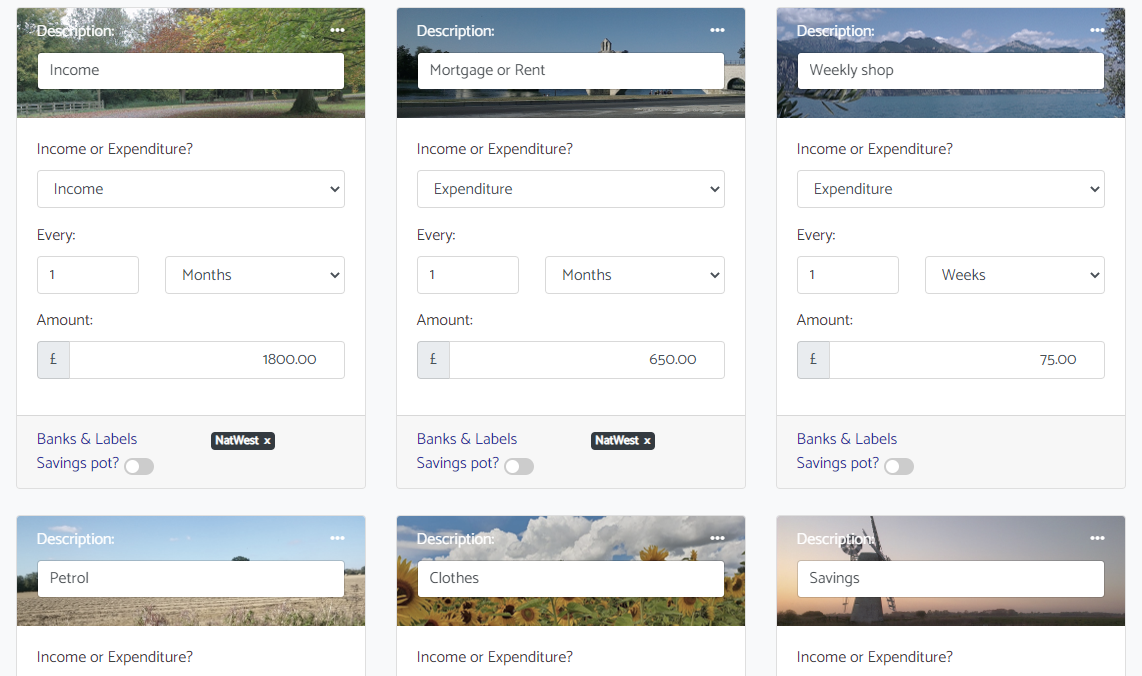

1) Calculate your income and expenditure

It is hugely empowering to gain an insight into how much you spend each month - and how that compares to your income.

The iBudge tool provides a simple interface to add all of your income and expenditure. And if you need a prompt to cover all items, simply select from the "Commonly used" section.

You will immediately see a real-time update on your monthly balance in the "Quick balance" badge in the bottom right of the page. You can then review your income and expenditure to try and achieve a surplus (or minimise your deficit) each month.

Once you are ready, head straight to the Income and Expenditure page.

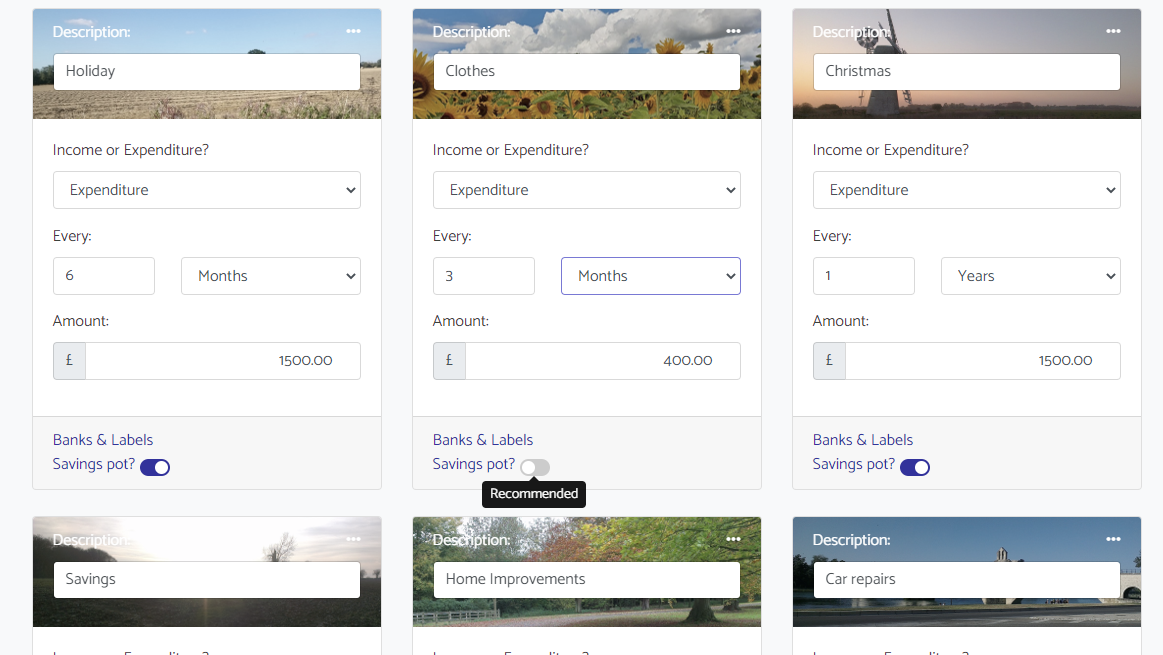

2) Create savings pots

A savings pot is recommended for any expenditure that occurs less frequently than your income.

Things like holidays, Christmas and car servicing are all obvious candidates for savings pots. But they could also be more frequent items like clothes purchasing or haircuts.

You can also add a savings pot to any expenditure item if you simply want to keep track of how much you spend. Savings pots allow you to track every item of expenditure (and income) to give you full visibility.

To set up a savings pot, simply flick the switch against the relevant expenditure item on your income/expenditure page.

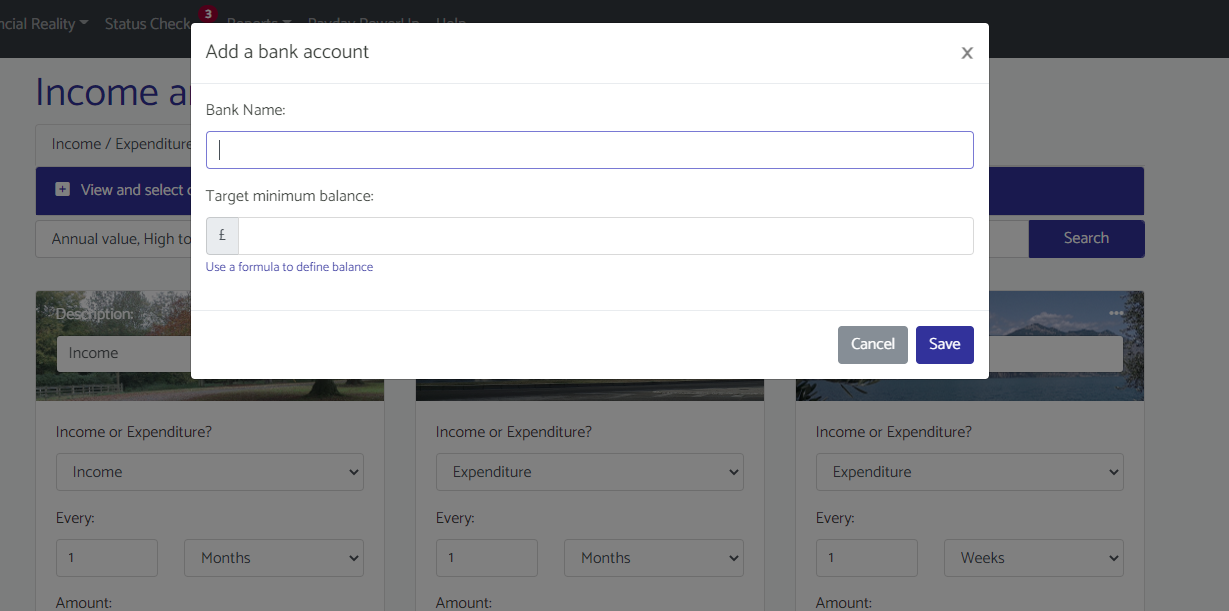

3) Capture bank accounts

Every item of income and every savings pot needs to be assigned to a bank account.

iBudge is especially powerful for users who have multiple bank accounts. Perhaps one for bill payments, one for savings and one for day-to-day spending.

Each bank account can be added from the income/expenditure page, with a link beneath each income/expenditure item to enable a new or existing account to be assigned. You can alternatively use the banks/labels page to add/edit accounts.

You will be asked for a target balance for each account. This can be a simple value (positive or negative) and you can also use a formula if you wish to capture dynamic details (the value of savings pots, other bank balances, the amount of time since you have been paying off an overdraft etc). More information on formulas is available separately.

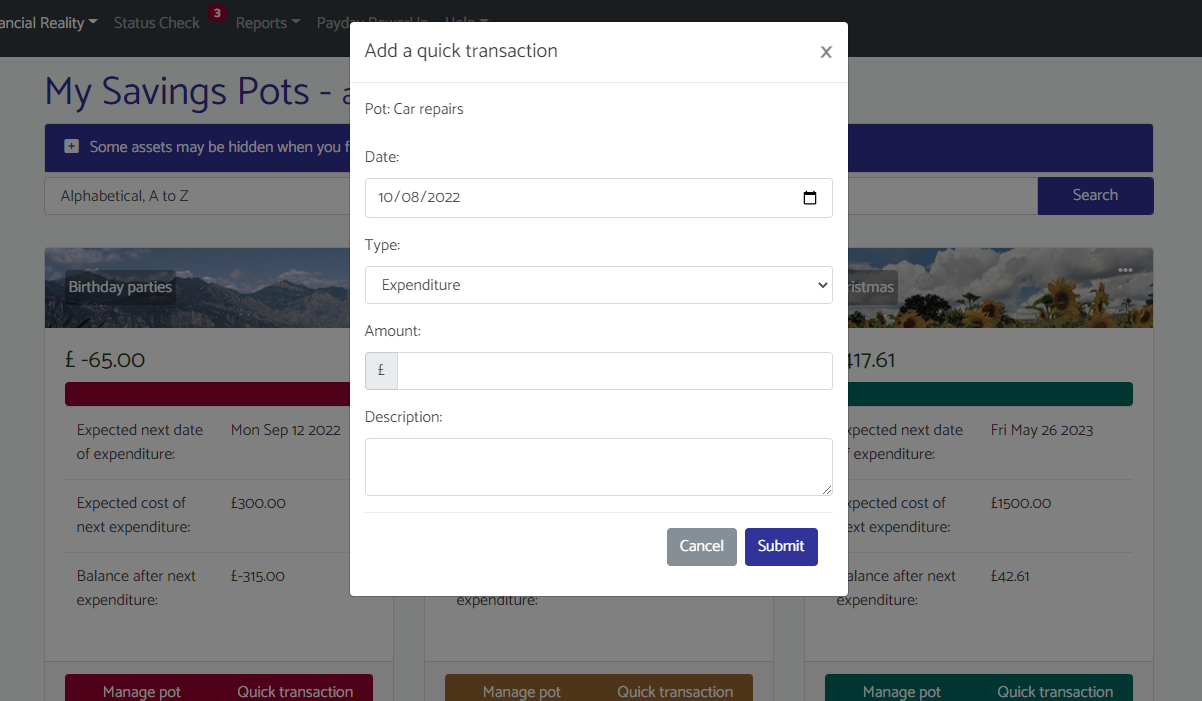

4) Track expenditure from savings pots

You need to keep track of the current balance of your pots - the easiest way to do this is to track all of your transactions.

The iBudge platform offers various ways to add transactions - either in real-time or retrospectively, perhaps once a month. Many users choose to use the "Simple View" of savings pots. This allows a quick transaction to be added as per the image.

iBudge also offers a "Matrix View" of all of your pots. If you are familiar with spreadsheets then you may prefer this option.

Premium users are also able to import a .csv file (downloadable from your bank's online facility) to rapidly capture all of the expenditure items in the last month.

5) Our exclusive Payday Powerup feature

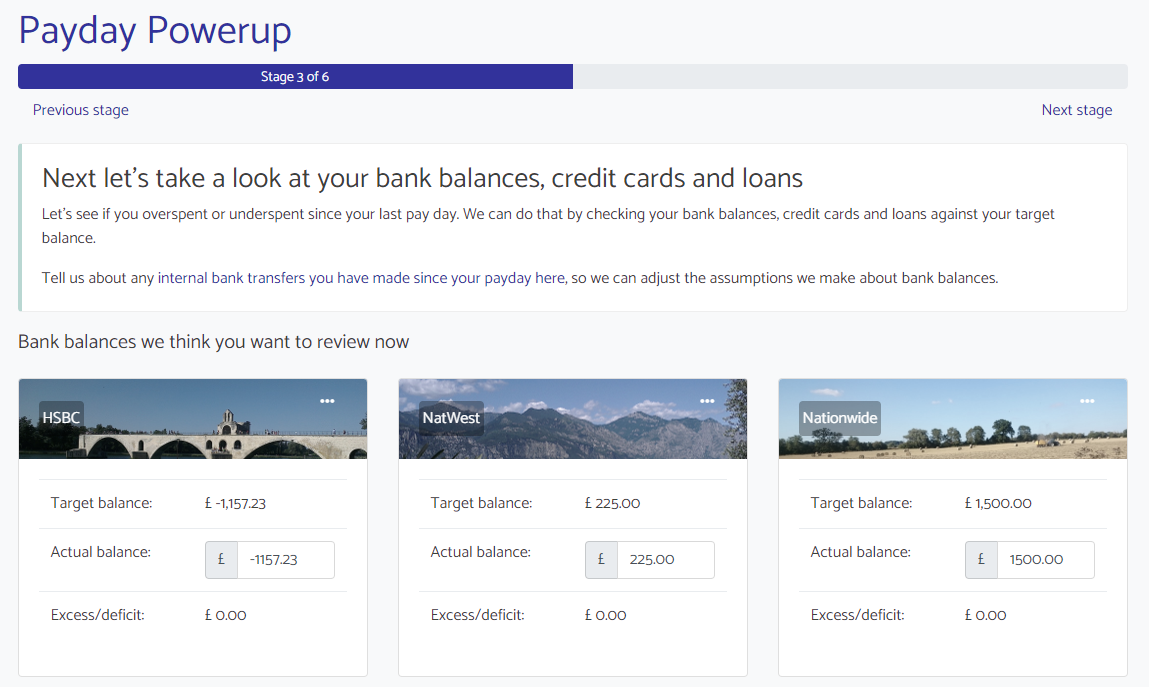

Payday Powerup is a unique guided decision making tool, which you should run after every payday.

Payday Powerup asks you to input your actual income, as well as your bank balances (as they were just before you got paid). Additional questions are asked about deferred income and expenditure (e.g. if you have expenses coming from work, based on payments you made during the last month).

It doesn't take more than a minute or two to provide all of the information and then the system uses machine learning and inbuilt calculations to work out your surplus or deficit - and support you to decide how to assign this amount across a variety of options.

Based on the decisions that you make, the tool will then advise any bank transfers you need to make - and will automatically top up your savings pots with the appropriate amount.

Find this page useful? Now check out our further free features for more information about features available within our free tier.