Your money, your budget. Simple.

Personal finance management just got a whole lot easier. Welcome to iBudge, home of the Payday Powerup.

Sign up for free, check out our top 5 features or keep reading for more information.

Ever run out of money before payday?

Or wondered how others have money left over for a holiday?

Good money management is simple... but only if you have the right tools. And you've just discovered the very best.

Sign up for free now or log in if you already have an account.

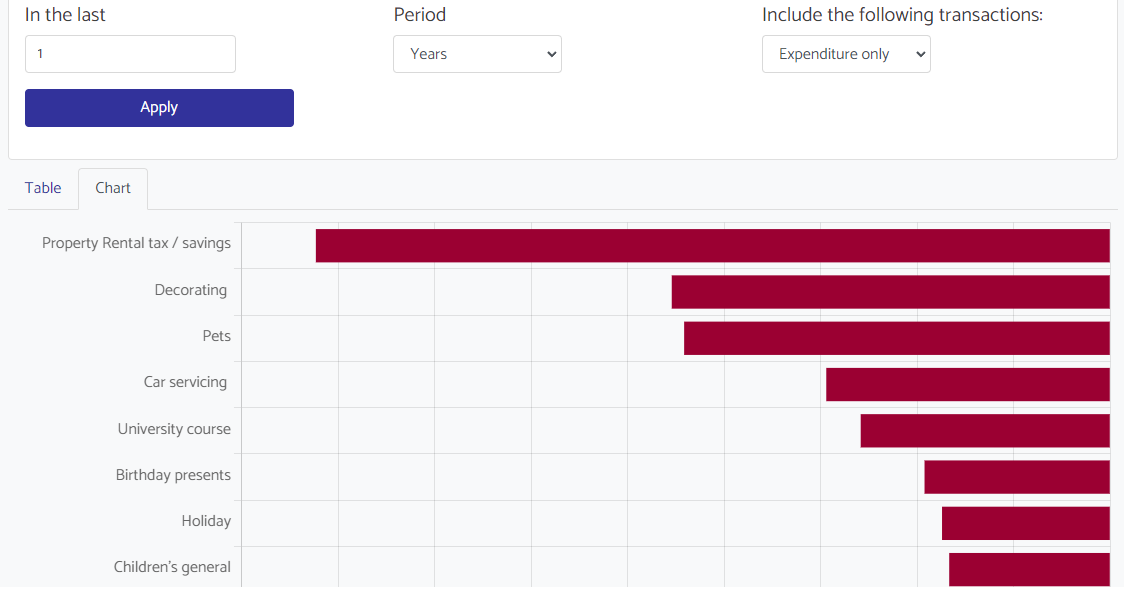

Do you know how much you spend?

When was the last time you calculated your expenditure compared to your income?

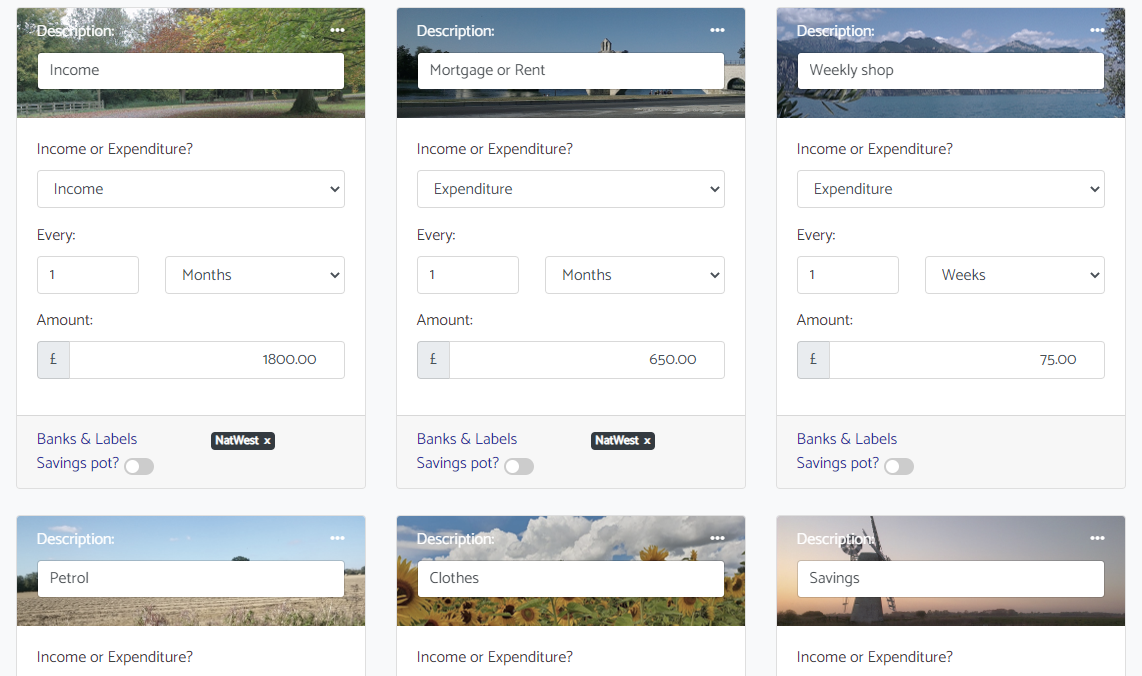

Start by working out your balance at the end of the month using our intuitive and simple tool.

Check out our top 5 features and futher features for more information.

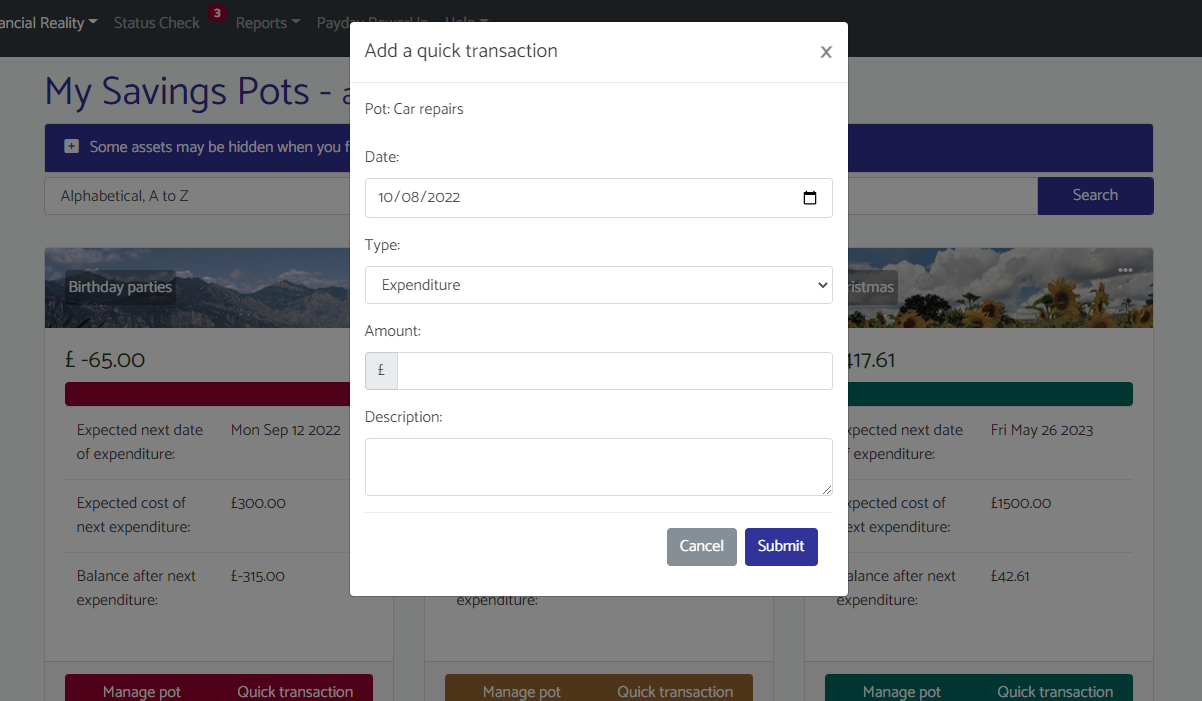

Set aside money in savings pots

Holidays, Christmas, birthday presents, servicing the car, annual subscriptions....

Set up savings pots for any item and lend yourself money from another pot if you need to.

Our blog post provides further details about ways you can use pots to manage savings.

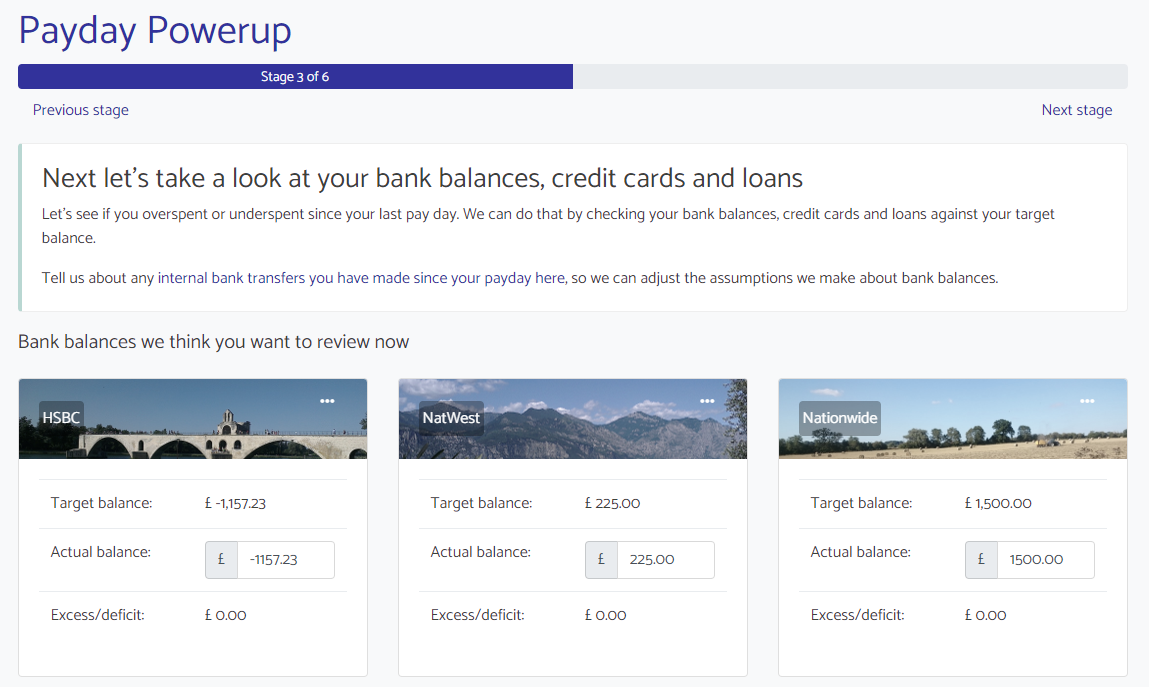

Guided decisions after every payday

Our Payday Powerup feature uniquely walks you through your allocation of money after you've been paid.

Gain full clarity on your savings, your approaching expenditure and spare cash you have to spend.

Sign up for free now or log in if you already have an account.

Gain full visibility of your financial status

Our headlines report offers an intutive graphical breakdown of your personal finances for any period of time.

Premium users additionally have access to a personal finance dashboard, with a wealth of reports and custom insights.

Check out our premium features and how they compare to our free tier in our feature comparison tool